SignalVault Blog RSS

The CDK Cyber Attack - How Hackers Crippled U.S. Auto Dealerships

The CDK Cyber Attack

Two and a half weeks ago, I traded in my wife’s Jeep Grand Cherokee. After the typical negotiat...

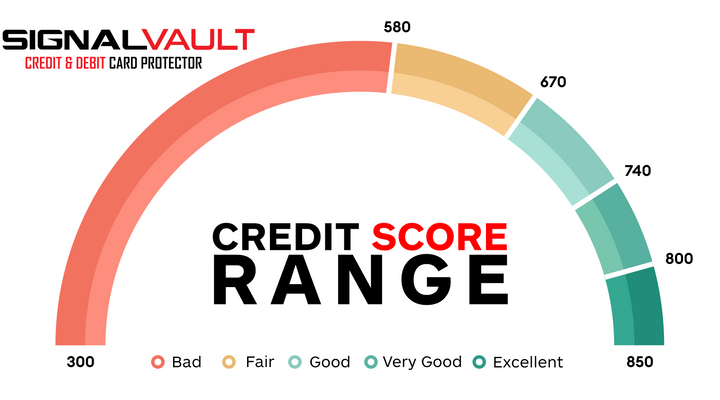

How To Boost Your Credit Score - The Right Way

For most people, their credit score is something they either flaunt with pride or hide with shame. Your credit scor...

Was My Garbage Man Dumpster Diving?

I have two IQCam Outdoor security cameras on the front of my house and I got a motion alert on garbage day. Normal...

The Benefits Of Smart Features & Home Automation

Adding smart features and automation to your home is a bright idea.

Staying Safe And Secure While Traveling

If you're like the one-third of Americans planning to travel more than 50 miles from home within the next year, you m...

The Very Real Dangers of Skimming

In today’s technology advanced society, it is easier than ever for savvy thieves to access and use your financial inf...

Beat RFID Skimmers Without Changing Your Wallet

Hackers have developed a slew of tools to help them achieve their nefarious goals. One of these devices that has grow...

Today's Credit Card Fraud

Credit card fraud - if you have never had it happen, you are lucky. Today, we all use our credit cards more than ever...

Why You Don't Need an RFID-Blocking Wallet

While technological advancements have the potential to improve the way that we live, new technology also brings with ...

Keeping Your Identity Safe During Spring Break

“Spring Break” makes me think of margaritas, beaches, travel and kids off of school. It’s a busy and fun holiday seas...